By Boulevard A. Aladetoyinbo

The Central Bank of Nigeria(CBN) has no plans to amend its extant legal tender laws, in view of its Central Bank Digital Currency(CBDC) project pilot launch October 1st, 2021, and beyond if successful. This came to fore after the Nigeria apex bank sent a strategic pilot implementation roadmap presentation to the Deposit Money Banks(DMBs) et al. weeks ago, ahead of e-Naira pilot phase launch 1st October later in the year. One of the instant implications is that the central bank enabling statute-law CBN Act (2007) and other legal tender laws remain intact; no amendment(s) in the face of fundamental monetary design policy changes or enhancement, and innovation to actualise the sovereign nation-state actor Nigeria cashless society policy objectives. The Central Bank of Nigeria(CBN) monopoly fiat money creation and control authority; “issue legal tender currency in Nigeria”, remains as enshrined in Section 2(b) of the Central Bank of Nigeria(CBN) Act 2007. Thus, the minting, issuance, distribution, redemption, and the e-naira CBDC digital currency destruction remain collectively the CBN regulatory remits.

E-Naira Design

The e-Naira Central Bank Digital Currency(CBDC) legal tender complements the existing paper money Naira banknote, and has features and characteristics, some of which are common with the extant fiat paper Naira banknote. Some of the design features and characteristics highlights to wit:

- E-Naira Automatic Legal Tender Status. The e-Naira is a legal tender without any new legal tender law conferring legal tender status on it. Therefore, the e-Naira is regulated under the Nigeria extant legal tender laws, regulation and compliance regime.

- Value Parity. The e-Naira has the same value as the extant fiat paper Naira banknote. Therefore, a non-electronic one extant fiat paper Naira banknote is worth the same nominal value and purchasing power as one e-Naira cash.

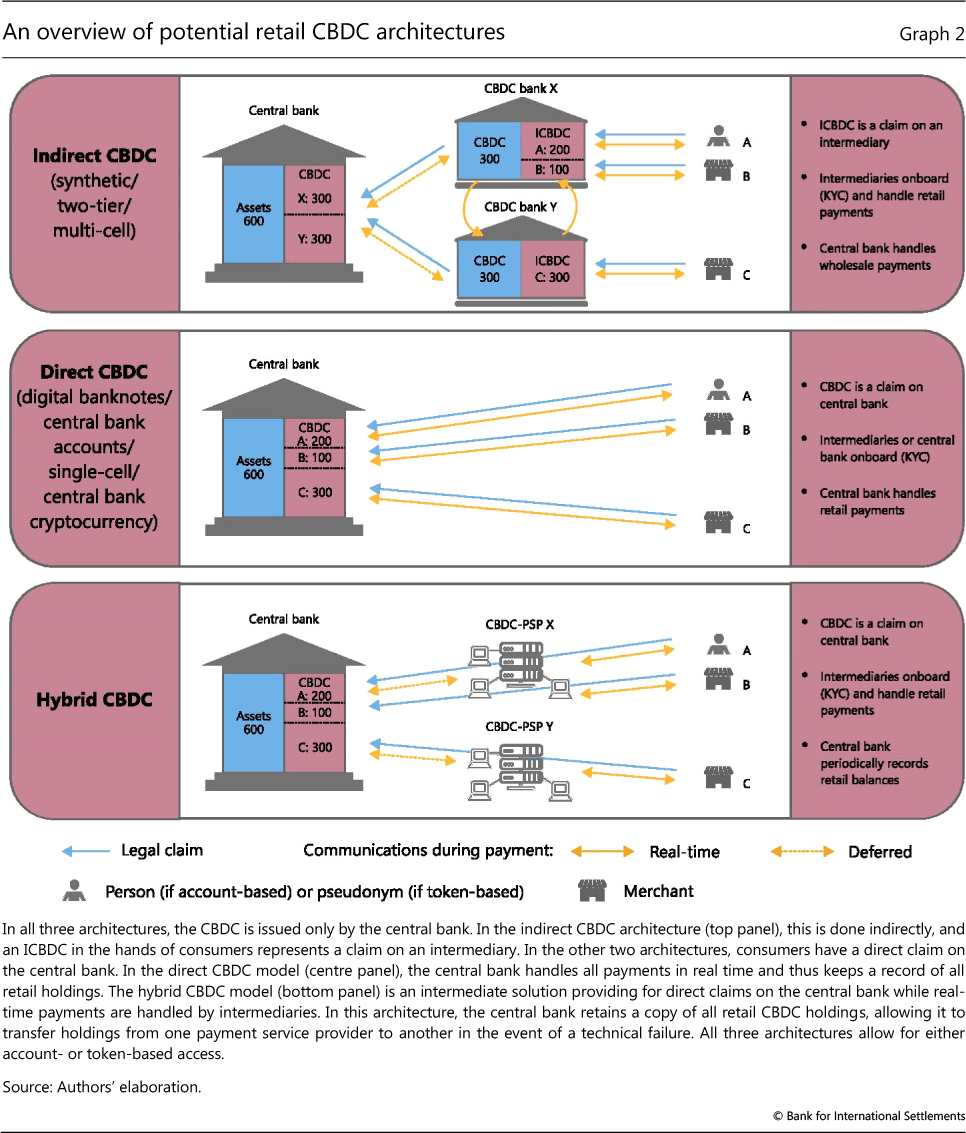

- Two-tiered Central Bank Digital Currency(CBDC) model. Various Central Bank Digital Currency(CBDC) design choices and considerations are:

- retail Central Bank Digital Currency(r-CBDC),

- wholesale Central Bank Digital Currency(w-CBDC),

- hybrid Central Bank Digital Currency(h-CBDC),

- synthetic Central Bank Digital Currency(s-CBDC),

- multi-Central Bank Digital Currency(m-CBDC).

Among sovereign central bank digital currency design choices available, Central Bank of Nigeria(CBN) has settled for a two-tiered retail Central Bank Digital Currency(r-CBDC) creation, distribution and management model, which runs through commercial banks and Payment Service Providers(PSPs) who can create wallets, but will be supported by the Central Bank of Nigeria(CBN) with speed wallet to meet 1st October 2021 pilot deadline purpose. e-Naira CBDC operating model cascades from Central Bank of Nigeria(CBN), Financial Institutions(FIs), Ministries Departments and Agencies(MDAs) to banked and unbanked consumers.

See source URL link

Account-based Wallet. The e-Naira CBDC has account-based wallet (opposite being token-based/value-based) features by allowing third party transaction validation, ledger updating and system security enhancement. The account wallet can be credited and debited. Further on the token-based system, a CBDC token created has a specific denomination. When there is a

a token transfer between or among parties, it equates near immediate ownership transfer, and there is no database reconciliation requirement. The scenario that plays out is best akin to when one party hands down a banknote to another. On the other hand, the CBN in this account-based wallet system approach holds and manages users’ CBDC accounts.

CBDC experts have always recommended a tokenised CBDC model on the grounds among others to avoid the responsibility of:

- large scale account keeping

- ” ” ” reconciliation

- attendant reputational risks in any event that things go wrong, i.e. poor service quality.

Customer Transaction Limit. There is a consumer wallet tier structure Tier 1, Tier 2, Tier 3.

Tier 1 applies to a consumer type that has no existing bank account. Such consumer daily characteristic transaction limit is send: NGN50,000 and receive: NGN50,000, while the cumulative daily balance is NGN300,000. This Tier 1 consumer minimum requirement consists of their telephone number validation with National Identity Number(NIN) attached. The existing as per MMO consists of the consumer’s passport photograph, name, place & date of birth; gender; address; (and the telephone number included).

Tier 2 applies to a consumer type that has an existing bank account. Such consumer daily characteristic transaction limit is send: NGN200,000 and receive: NGN200,000, while the cumulative daily balance is NGN500,000. This Tier 2 consumer minimum requirement consists of their Bank Verification Number(BVN). The existing as per MMO consists of, in addition to Tier 1 requirement and BVN, Identity (ID) evidence.

Tier 3 applies to a consumer type that has an existing bank account. Such consumer daily characteristic transaction limit is send: NGN1,000,000 and receive: NGN1,000,000, while the cumulative daily balance is NGN5,000,000. This Tier 3 consumer minimum requirement consists of their Bank Verification Number(BVN). The existing as per MMO consists of the Tier 2 requirements in addition to physical verification, full Know Your Customer(KYC) as stipulated in the extant CBN AML/CFT regulations, i.e. Central Bank of Nigeria(CBN) (Anti-Money Laundering and Combating the Financing of Terrorism in Banks and Other Financial Institutions in Nigeria), 2013.

A merchant also comes under the Tier 3, and has consumer daily characteristic transaction limit, which is send: NGN1,000,000 and receive: NGN1,000,000, while cumulative daily balance has no limit that they can sweep to their bank account. And full KYC as stipulated in the extant CBN AML regulations is applicable to them.

Tiered AML/KYC Approach(NIN, BVN as unique identifiers). There is a consumer due diligence tiered structure approach as evident in the “Customer Transaction Limit” vis-a-vis consumer identity verification applicable to Tier 1, Tier 2, and Tier 3 from the telephone number validated as NIN attached minimum requirement where no bank account exists prior to the BVN requirement where a bank account exists prior, and finally Tier 3 which consists of Tier 2 requirements such as BVN, physical verification, and full KYC as stipulated in CBN AML/CFT Regulations.

Non-Interest Bearing e-Naira CBDC. The two major questions in CBDC design consideration choices are whether the CBDC is interest-bearing and whether network effects matter. Where a CBDC is non-interest-bearing, like the e-Naira CBDC, its cash similarity becomes its sole design instrument. The e-Naira non-interest-bearing CBDC design choice is deemed the most optimal CBDC design choice, as CBDCs though blend in features of cash and deposits, could also equally crowd out cash and deposits demand. In specifics, the e-Naira CBDC designed cash-like, can cause cash demand reduction beyond the point where the e-Naira network effects cause cash disappearance, while a deposit-like CBDC design choice causes an increase in deposit, loan rates, and bank-to-lender contraction. This bank intermediation decline as a result curtails investment and output. In any case that cash vanishes, the e-Naira CBDC moves optimally toward cash, as it bears the brunt of servicing former cash users, and remains in existence instead of having the three money forms cohabitation. It should be obvious that where CBDC network effects occasion no monetary policy constraint, the CBDC should be designed with zero interest rate. Reason for this is that it could cause price distortions in a household payment instrument choice.

The e-Naira CBDC, like the fiat paper banknote before it, has no interest-bearing feature whatsoever, i.e. therefore the e-Naira will not;

- be a storehold of wealth

- generate any interest or returns

- have an intrinsic value

Settlement Finality. The e-Naira CBDC has the power to discharge a user from an obligation when used for fund transfer purposes to effect payment and settlement. It could be used to settle an obligation irrevocably and unconditionally as a payment or financial instrument. Finality of settlement in a financial securities capital market context entail irrevocable and unconditional fund and securities transfers.

Boulevard A. Aladetoyinbo, Esq.

Head, Crypto-asset Capital Formation Practice.

Lex Futurus (Africa Region).

Follow @BoulevardLP on Twitter.

Disclaimer

This article has no legal advice piece intention. It serves informational and educational purposes only.

When someone writes an article he/she retains the plan of a user in his/her brain that how

a user can understand it. Thus that’s why this article is

amazing. Thanks!

Feel free to surf to my site :: Joker 123