The Ministry of Finance has allayed fears about President Bola Tinubu’s $21.5 billion borrowing request.

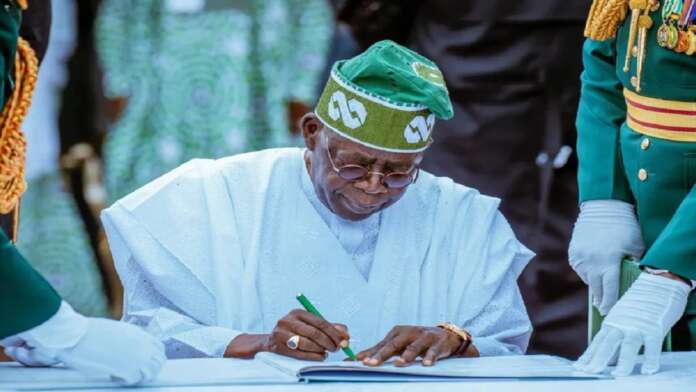

On Tuesday, Tinubu wrote to the National Assembly requesting approval for a new external borrowing plan totalling over $21.5 billion.

President Tinubu also sought the lawmakers’ green light to issue federal government bonds worth N757.9 billion to settle outstanding pension liabilities under the contributory pension scheme (CPS).

But a statement issued by the Ministry of Finance’s Director of Information and Public Relations, Mohammed Manga, on Tuesday said the borrowing plan forms a key component of the 2024–2026 External Borrowing Rolling Plan, which outlines the financing needs of both federal and sub-national governments over two years.

The Ministry emphasised that the borrowing framework does not amount to immediate or blanket debt accumulation. Rather, it is a strategic, forward-looking tool designed to facilitate effective financial planning and ensure alignment with Nigeria’s Medium-Term Expenditure Framework (MTEF), under the Fiscal Responsibility Act, 2007, and the DMO Act, 2003.

“The Debt Rolling Plan is not an automatic green light for increasing the debt burden. It is a strategic framework that guides sustainable and purposeful borrowing,” the statement reads.

“This strategic method enhances Nigeria’s ability to implement effective fiscal policies and mobilize development resources.

“Importantly, it should be noted that the debt rolling plan does not equate to an automatic increase in the nation’s debt burden.”

Manga further disclosed that most of the funds will be sourced from concessional lenders and development partners such as the World Bank, African Development Bank, French Development Agency, European Investment Bank, JICA, China Eximbank, and the Islamic Development Bank.

“These institutions provide concessional financing with favorable terms and long repayment periods, which aligns with the country’s development needs,” the statement added.

According to Manga, the plan is designed to support critical investments in infrastructure, transportation, energy, and agriculture — “sectors central to achieving rapid, inclusive, and sustained economic growth”.

“Our borrowing strategy is guided not by the volume of loans but by their utility, sustainability, and the economic value they generate. Each facility will be strictly tied to growth-enhancing projects,” the ministry said.