“The value of the Naira will never rise or recover until the present crop of leeches sucking our economy dry are dislodged from power and brought to justice to account for the trillions and trillions of Naira/dollars they have stolen from our commonwealth over the years and the concomitant punishment their wickedness has inflicted on the masses of our people.” – Dr. G.A. Onuoha

Experts are divided in their opinions about the move by the Central Bank of Nigeria, CBN, to redesign the Naira.

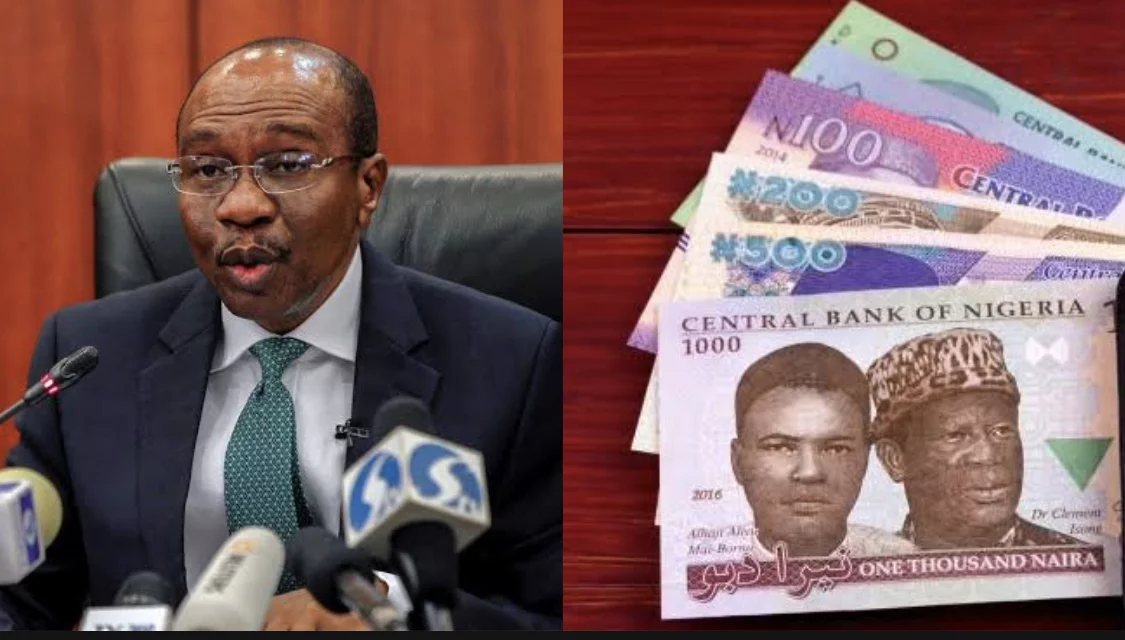

The CBN Governor, Mr. Godwin Emefiele who at a press briefing in Abuja on Wednesday announced that the exercise would affect the upper denominations— 200, 500, and 1000 notes, further revealed that the plan is a strategy to take control over the circulation and integrity of the naira notes.

However, in a statement made available to Law & Society Magazine, Law Teacher and Legal Practitioner, Dr. G.A. Onuoha said redesigning the naira will not positively impact the economy. The statement titled: “The Proposed Introduction of New naira Notes Not an Antidote to the Inflationary Spiral in Nigeria”, disagreed with the CBN Governor. Below are excerpts.

It was reported recently that the Nigerian Central Bank Governor, Mr. Godwin Emefiele, proposes to introduce new Naira notes of various denominations into circulation. I don’t know the motive for the proposed introduction of the new Naira notes, but if the purpose is to curb inflation in the country, then the CBN Governor and his economic/fiscal advisers should better think again and in fact, go back to the drawing board.

To start with, the colour or size of any currency notes does not, in any way affect or improve the value of the currency in circulation. At best, it gives a cosmetic effect on the appearance of the currency notes but in no way improves or adds to the monetary or economic value of the new brand of the same currency. In monetary terms, the value of any currency appreciates when there is sufficient or surplus quantity or amount of goods and services available in the economy such as to grow the economy by creating jobs for the teaming youth and graduate population in the country. Even the not-so-educated section of such society shares in the resultant economic prosperity of a growing or booming economy.

In such an economy, old industries experience expansion while new ones emerge to compete with the old and create healthy industrial/economic competition in contradistinction to monopolies that stifle the market and create unnecessary scarcity of goods and services to the detriment of the overall health of the economy and the wellbeing of the average citizen. What Nigeria needs to do in order to improve the value of the Naira is to expend some of the Billions of Naira currently being stolen by politicians and/or wasted on useless white elephant projects (such as the billions of dollars expended on the Nigeria-Niger Railway line), on the establishment of mostly high-tech industries and related start-up tech companies that can absolve the overflowing and currently wasting the energy of our youthful population from various tertiary institutions in this country.

Creation of employment in various sectors of the economy and concomitant depopulation of the labour market is one of the ways of creating economic prosperity and strengthening the value of the local currency which can now compete favourably with foreign currencies. It is the strength of the national economy – how many jobs it creates, the number and production capacity of such industries, and their coterminous effect on the prices of goods and services available in the economy that boosts the value of the currency not printing more currency notes or changing the colour of such currency.

In the case of Nigeria, corruption is the greatest problem with respect to the falling value of the Naira. Corruption creates economic morass; one of the multiplier effects is to weaken the value of the Naira since trillions of Naira belonging to the commonwealth are in private bank accounts while society at large, including the national and State Governments, are virtually bankrupted to the point of borrowing practically to run the Government itself and provide essential services to the people.

The Federal Government of Nigeria currently borrows to pay the monthly salaries of its workers! It’s that bad! Why won’t the value of the Naira go down to the dust? Why not, when almost all the funds required to set up industries to employ our teeming youth population are in private, thieving, unpatriotic hands? Why won’t the value of the Naira kiss the dust when on a daily basis, Government officials and their accomplishes are busy stealing and shipping Nigeria’s crude oil abroad to be refined and sold in foreign lands with the profits going into their private pockets while the masses suffer hunger and die of preventable diseases? What wickedness!

The value of the Naira will never rise or recover until the present crop of leeches sucking our economy dry are dislodged from power and brought to justice to account for the trillions and trillions of Naira/dollars they have stolen from our commonwealth over the years and the concomitant punishment their wickedness has inflicted on the masses of our people.

The other day in China, the former Minister of Justice was sentenced to death for stealing $16m of the people’s money! Such death penalty for stealing public funds should be quickly introduced in Nigeria to checkmate the rapacious grand larceny of our public officials in order to improve our economy and boost the value of the Naira.

Likewise, the Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf, described the proposed redesigning of the naira as embarking on a wasteful exercise and a distraction.

His words: “It is difficult to see any compelling value proposition of this currency redesign idea. The cost of such an action would be outrageous and disproportionate compared to the expected benefits advanced by CBN.

“At a time when the government is grappling with the high fiscal deficit, debt crisis, severe revenue crisis, and underfunding of many government projects and programmes, it is most inappropriate to embark on such a profligate exercise.

“Currency as a percentage of money supply is less than seven percent. The exercise, therefore, has no monetary policy significance. Besides, it will come with huge logistics costs and avoidable dislocations to small businesses, most of who are in the informal sector.

“This is one intervention we can do without. There are more urgent issues demanding the attention of CBN.

Similarly, the Executive Director, Technical of Anchor Insurance Limited, Mr. Adebisi Ikuomola, said that he doesn’t see the development having any tangible effect on the economy or strengthening the naira.

“The CBN said that the move is geared towards reducing the volume of naira in circulation, however, I don’t see how that can positively affect the economy or strengthen the naira. The naira is weak in the foreign exchange market and this policy may not turn that around,” Ikuomola said.

In the same vein, analyst and Vice Executive Chairman, HighCap Securities Limited, said: “ I am yet to know CBN’s justification for this action. Several speculations are floating around but the shocking move appears to be an attempt to ascertain the volume of those notes in circulation and probably deal a blow on those dealing illegally in them.

“If my speculation is wrong, merely redesigning a currency is not likely to change its value. The inflation ravaging the Naira now which is diminishing it’s value is as a result of scarcity of forex, goods, and over creation of the currency by CBN.”

The cost of redesigning and printing the new notes will be another dent on CBN’s balance sheet which will also deplete the country’s forex reserve. The exercise may just be a costly motion without movement and a futile rescue mission.”

But, Prof. Uche Uwaleke, President of the Association of Capital Market Academics of Nigeria (ACMAN), holds a different view. “I think the decision to replace some naira denominations with new ones will be positive for the economy in the medium to long term.

“First, although the measure does not amount to demonetization of big currency notes often carried out by Central banks to curb black money and corruption, it will go a long way in ensuring that a lot of naira notes circulating outside the banks are crowded in.

“If it leads to large deposits in banks, it means the banks will have more money to lend which may reduce interest rates. I also think it may have the effect of reducing speculative attacks on the naira in the parallel market. I expect that the Financial Intelligence Unit will be on the watch out for huge deposits as a way of monitoring illegitimate transactions.”