By Sylvester Udemezue

Please, spare a minute or two to watch the attached video.

See also the 18 February 2023 news report which came under the title, “Cash Crunch A Blow For Politicians Ahead Of Elections — Hon Doguwa” and which reports Hon Ado DOGUWA as saying, inter alia, that “each member of the House of Representatives is entitled to N70 million cash to pay polling agents and for other election running costs, stating that if they have no hard cash, they will be disadvantaged in the exercise. [ThenigeriaLawyer; 18 February 2023]. House of Representatives member

Hon Ado Doguwa’s indirect confessional speech as shown in the video leaves no one in doubt that, with the Naira Redesign, Daily Cash Withdrawal Limit and swap policies, recently introduced by the Central Bank of Nigeria (CBN), on/with President Buhari’s directives/approval (pursuant to Sections 17, 18, 19 and 20 of the CBN Act, 2007), it appears that Mr President Buhari and the CBN have considerably reduced the capacity of all Nigerian politicians to carry huge CASH around (in “HARD COPY”, according to Hon Ado DOGUWA) during general elections and electioneering campaigns, usually for the criminal purpose of vote buying, voter inducement, and manipulation of the electoral process, among other electoral malpractices resulting in grossly flawed elections that naturally produce bad leaders. Bad leaders are a plague on any country.

While I acknowledge that the policies came with side effects and attendant adverse implications on ordinary Nigerians, I respectfully submit that the advantages of the policies are already beginning to manifest themselves, as illustrated by Hon DOGUWA’s confession which I think was borne out of frustration in the face of stack realities brought about by the policies.

Let’s look at some of the ways the policies might be said to have positively affected Nigeria and Nigerians.

(1). A February 19, 2023 newswirelawandevents news report under the title “NAIRA SCARCITY: COMMERCIAL S3X WORKERS COUNT LOSSES, DECRY LOW PATRONAGE” has it that “One s3x worker, said her customers had reduced drastically due to the current ‘no cash syndrome'”.

Thus, the policies may end up sanitizing some sectors of Nigeria. It’s believed that majority of the men that patronize female commercial sex workers wouldn’t want to do payments through transfers as this might reveal their true identity which may not be good for their public image. Thus, business is going down somehow, thanks to introduction of the cashless policy.

.(2). Reports of armed and highway robberies have reduced drastically in different parts of Nigeria in the past one month. Which cash they wan collect?

(3). There appears to be a zero report of Bank robbery in all parts of Nigeria in the last 3 weeks or thereabouts

(4). Many online and mobile banking apps and platforms hitherto left grossly unutilized or underutilized are now being put to maximum use. In that way, the capacity and effectiveness of Nigerian Banks to handle or sustain online transactions on their respective ICT platforms are now being put to test. Those banks that had thought their internet and mobile banking setups and structures were stable, efficient and effective are now beginning to see obvious loopholes and weaknesses in their platforms. This would lead each Bank to undertake massive upgrades and strengthening of its ICT platforms with a view to serving the public better. The ultimate winners are the Nigerian public who would benefit from these upgrades that could usher in better cashless banking experiences

(5). Reports of kidnap-for-ransom by terrorists and other criminals, have gone down drastically in parts of Nigeria. Where would anyone get huge cash to give kidnappers as ransom? The result is that kidnappers appear to be in search of other/alternative source of revenue or means of livelihood, leading to drastic reduction in cases of kidnapping and criminality.

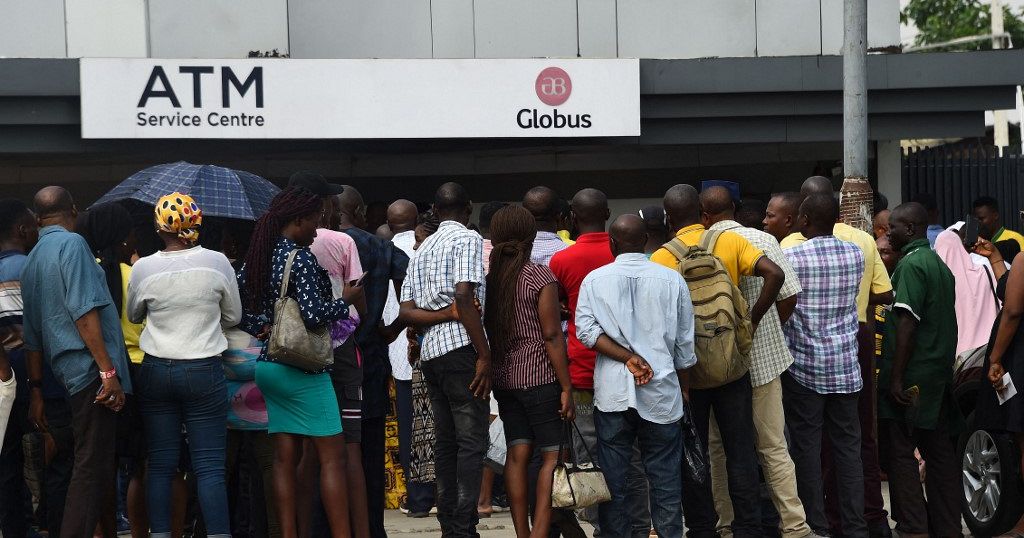

(6). Reports of those fraudsters (419ners) or robbers who at gunpoint usually force innocent Nigerians to ATM machines/galleries with a view to getting the victims to empty their bank accounts with ATM Cards, have gone down drastically. If any thief takes one to the ATM machines now, the highest he can get from one is N20,000 or N10,000. Is it worth the risk? Hence, the business is no longer booming.

(7). What about reports of some unscrupulous, criminal-minded POLICEMEN and security agents who usually stop Nigerian youths on the roads, unlawfully force them to reveal the balances of monies in their bank accounts, and thereafter blackmail them with allegations that they’re Yahoo-yahoo boys, following which they (the policemen) force them to go to ATM machines and withdraw huge cash for giveaway as bribes to the policemen to avoid being arrested or prosecuted on the trumped up charge of being “Yahoo-Yahoo Boys”? These thieving policemen appear to have now been knocked out of business with the Naira Redesign and Daily Cash Withdrawal Limit policies of the Central Bank

(8). Generally, people now spend wisely, as a result of the introduction of cashlessness in much of our affairs.

(9). Many businesses that hitherto depended on cash, appear to have now learnt to practice the cashless style which is safer, reduces corruption and leaves permanent records, which could be recalled in the future.

(10). Fewer people now carry huge cash around, unlike was usually the case. Carrying cash around comes with huge risks, which appear to get reduced when you carry little cash and do more cashless transactions

(11). People with the habit of stockpiling unnecessarily huge amount of cash in vaults at home, in the offices or in some other places outside banks, have now been made to open and operate accounts in Banks and to deposit their monies in the Banks which is safer and more in tune with global best practices and prevailing 21st-century standards. In this way, the risk of such cash being stolen at home is no longer there. Besides, releasing these stockpiled cash, the amount of cash hitherto held up at home and stopped from circulation is now considerably reduced.

This is good for the economy. Besides, we need to grow and not remain in the archaic modes of life which carrying huge cash depicts.

(12). Then (this must be restated as a major benefit) one could notice that the usual practice of corrupt and unscrupulous politicians throwing cash around anyhow during elections and political campaigns, appears to have gone down even with the 2023 elections barely days away. During past elections in Nigeria, voter inducement in the name of TraderMoni and other forms of criminal Vote Buying and spraying and sharing of huge amount of cash to unsuspecting and gullible Nigerians with a view to controlling and swaying their choice during the elections by deceiving them with money, would have BY NOW reached their peak. On the contrary, one could notice that preparations towards the 2023 Elections appear slightly different. Not that the ugly practice of sharing cash for votes, has been wiped out, but that the volume has been considerably deflated. It’s therefore good news that 2023 Elections might turn out to be the first elections in Nigeria where money and material things played the least role in detrmining who wins the elections. It’s a huge good news attributable to the Naira Redesign and Daily Cash Withdrawal Limit policies of the CBN.

There are many other benefits of the Naira Redesign and Daily Cash Withdrawal Limit policies of the CBN, if the polices are effectively managed to ensure the huge benefits are effectively harnessed while any unbearable side effects on the part of Nigerians are reduced. Everything good usually comes with some level of pain and sacrifice on the part of the people for whom it befits. Yet, since these polices are in the interest of the people, the people themselves should not be made to suffer unbearable or excessive suffering; the people need to be alive in order to enjoy the benefits of the policies.

May God help Nigeria. Amen

Respectfully,

Sylvester Udemezue (Udems)

08109024556.

[email protected].

(17 February 2023)

POST SCRIPTUM:

Please watch the short drama/song in the attached video, which appears to help to illustrate how some Nigerians are already gradually adapting to what may well end up as the new normal: CASHLESSNESS.

Thank you.